Workplace Financial Education

Executive Summary

Cultivating a Well-Structured Employee Experience

Our commitment to employee well-being extends beyond traditional measures, recognizing the profound impact of benefits and wellness programs on the employee experience. In an era marked by economic uncertainties, these initiatives serve as vital pillars of support, fostering a culture of care and resilience. By prioritizing a meticulously structured employee experience, we align every aspect of employment with our organizational vision and objectives, driving sustainable growth and prosperity. As generations evolve, so do their expectations, making it imperative for employers to demonstrate genuine care through tailored benefits offerings. At the heart of our strategy lies the belief that employees who feel valued and supported are key drivers of organizational success.

DID YOU KNOW?

60%

of workers report living paycheck-to-paycheck.

55%

of workers say they are living paycheck-to-paycheck, up from 43% in 2022.

54%

of Americans report stopping or reducing their retirement savings altogether because of higher prices.

55%

say they are in control of their finances, down from 61% in 2022.

43%

report drawing money out of their retirement accounts to pay for daily expenses.

52%

say they have a three-month savings cushion, down from 62% in 2022.

Why Financial Wellness is Important?

EMPLOYEES CITING FINANCIAL CONCERNS AS A CAUSE OF LOWER MENTAL HEALTH - 31% in 2022 - 48% in 2023.

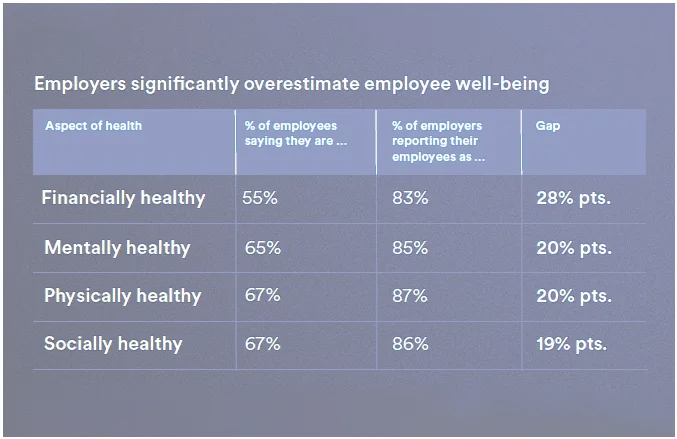

Greater employee well-being is a critical win-win goal, offering meaningful value for both employers and employees. However, there is a significant and growing gap in how employers assess the health levels of their employees and how workers say they are feeling.

Benefits to

Employer

Decreased Productivity

Employees grappling with financial stress spend anywhere from 20 to 80 hours monthly addressing personal financial concerns during work hours. Resulting in an employer cost of up to $7,000 per employee annually.

Financial strain is taking a toll on your company's finances!

Increased Turnover Rates

A significant 40% of employee departures can be attributed to stress-related factors.

Ranging from $3,000 to $13,000 to replace each departing employee.

HR Department Disruptions

The Human Resources team faces numerous distractions including managing bill collectors, processing 401k loans, and wage garnishments, among others. These distractions can consume up to 10% of the HR Department's payroll budget.

In summary, employers aspire

for a thriving workplace:

Enhanced loyalty.

Heightened productivity.

Augmented engagement.

Elevated job satisfaction.

Benefits to

Employee

Increased Productivity and Satisfaction

By providing financial education to employees, employees can become more engaged, productive and satisfied with their jobs.

Strong financial wellness programs decrease financial stress in workers!

Increased Retirement Income

A recent Principal study found that workers who commit to and participate in a financial wellness program could increase their expected retirement income by an extra $905 a month, or an additional $242,000 at retirement for a typical worker!

Increased Financial Wealth

Principal also found that those attending seminars appear to increase financial wealth by approximately 18%.

Increased Retention

Employees who are offered wellness programs & benefits are 1.6x more likely to stay.

In summary, employees aspire

for a thriving workplace:

Success in their work.

A sense of belonging.

Feel valued and appreciated.

Happiness.

Our Process

Employee

Outreach

Financial

Wellness Assessment

Group

Sessions

Schedule

1 on 1

Meetings

Personal

Action Plan

Employer

Reporting

WE MAKE IT EASY!

A dedicated account executive.

A coordinated and experienced team.

Simple execution and implementation.

Clear next steps that make it easy to engage and take action.

Our Offerings

Digital Solution:

Introducing a cutting-edge personal finance app designed to facilitate long-term planning by assisting individuals in scrutinizing their spending habits. This innovative tool has the potential to liberate finances by enhancing day-to-day money management.

Workshops:

Engage your workforce with a range of virtual or in-person financial and retirement education workshops. Empower your employees with valuable knowledge to navigate their financial future effectively.

Personal Financial Guidance:

Offer your employees access to personalized, one-on-one educational consultations with trusted third-party financial experts. These consultations aim to empower individuals to make well-informed financial decisions.

Our Workshops

Unlocking Financial Confidence Through Tailored Workshops

At the heart of financial empowerment lies education. Our comprehensive workshop series caters to individuals of all ages and career stages, providing invaluable insights to boost financial confidence. Partnering with you, we curate a personalized selection of workshops perfectly aligned with your business's needs and the aspirations of your associates or affinity groups.

Choose from our extensive catalog of over 40 distinct one-hour workshops, each meticulously crafted to address the diverse spectrum of workplace populations. From foundational financial principles to advanced strategies, our workshops offer practical knowledge and actionable advice tailored to your audience.

Invest in the financial well-being of your team today. Together, let's pave the way to a future of financial empowerment and success.

Build a strong foundation for your business with Cerebrum Strategic Advisors

Transform your business with us.